Get This Report about Offshore Company Management

Wiki Article

Excitement About Offshore Company Management

Table of ContentsTop Guidelines Of Offshore Company ManagementThe Of Offshore Company ManagementThe Greatest Guide To Offshore Company Management8 Simple Techniques For Offshore Company Management

This is because the business is signed up in a various jurisdiction that is typically past the reach of tax obligation authorities or competitors. If you are in the US, however sign up the firm in a jurisdiction like Seychelles or Belize, you can rest assured that your data is protected.Establishing an overseas firm supplies many tax benefits since they are exempt from the higher taxes that onshore companies should pay. You will not go through the exact same tax obligation rates as domestic companies, so you can save a large amount on tax obligations. Moreover, the jurisdictions where overseas firms are typically signed up often have double taxes treaties with various other countries.

An overseas firm is additionally a lot more flexible pertaining to guidelines and conformity. The laws in the territory where you sign up the business might be less stiff than those in your home country, making it less complicated to establish the company and run it without excessive paperwork or lawful trouble. You will likewise have fringe benefits, such as utilizing the company for worldwide profession.

This is because the business is signed up in a territory that may have a lot more flexible possession defense laws than those of your house nation. For example, if you choose the ideal territory, creditors can not easily take or freeze your abroad assets. This ensures that any type of cash you have actually purchased the company is safe and also secure.

What Does Offshore Company Management Do?

Offshore companies can be used as vehicles to protect your properties versus possible plaintiffs or financial institutions. This indicates that when you die, your beneficiaries will inherit the properties without interference from financial institutions. Nevertheless, it is necessary to speak with a lawyer before establishing an offshore company to guarantee that your properties are effectively secured.Offshore jurisdictions typically have less complex needs, making finishing the enrollment process as well as running your company quickly a wind. Additionally, a lot of these jurisdictions offer online incorporation solutions that make it even extra practical to register a company. With this, you can promptly open up a company savings account in the territory where your firm is registered.

Setting up an offshore company can assist minimize the possibilities of being taken legal action against. This is since the legislations in many territories do not allow foreign firms to be sued in their courts unless they have a physical presence in the country.

Offshore Company Management - Truths

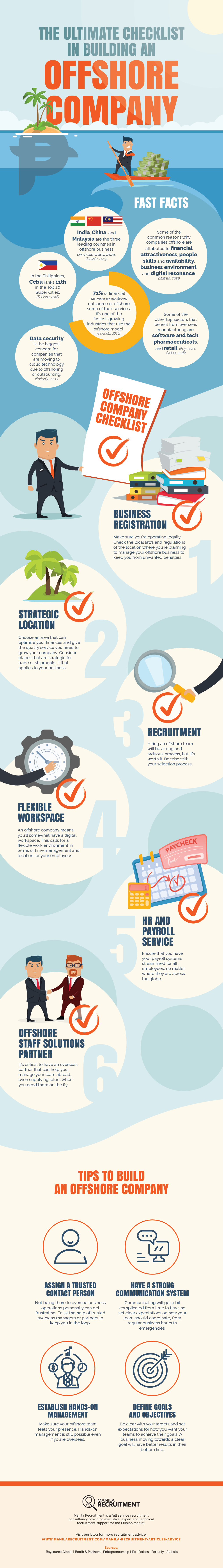

Establishing a firm in one more country can be rather easy. There are many countries that provide advantages to businesses that are you can check here wanting to establish an offshore entity. Some of the benefits of an offshore business include tax benefits, privacy and also discretion, lawful security and asset protection. In this blog site we will certainly look at what an offshore company is, puts to think about for maximum tax advantages as well as additionally overseas consolidation and also established.

Numerous countries provide tax benefits to business from various other countries that move to or are incorporated within the territory. Firms that are created in these offshore jurisdictions are non-resident because they do not perform any economic deals within their borders as well as are owned by a non-resident. If you intend to establish up an overseas firm, you need to utilize a consolidation agent, to make certain the documents is finished properly as well as you obtain the most effective advice.

Examine with your formation representative, to ensure you do not break any constraints in the country you are creating the company in around safeguarded business names. Consider the kinds of shares the company will certainly issue.

The Best Strategy To Use For Offshore Company Management

Offshore organization structures might hold an unique status that makes them non reliant regional residential taxes or are called for to pay tax obligations on their around the world income, capital gains or revenue tax. offshore company management. If your overseas firm go to website is importing or exporting within an overseas area, as an example, receiving orders directly from the client and also the purchased items being sent out from the manufacturer.

For UK citizens, supplied no amounts are paid to the United Kingdom, the capital and income earned by the offshore business stay tax-free. Tax obligation responsibilities normally are figured out by the nation where you have permanent residency in and also as helpful owners of a company you would certainly be reliant be taxed in your nation of home - offshore company management.

Tax commitments differ considerably from nation to nation so its vital to make certain what your tax responsibilities are prior to selecting a territory. Offshore business are only based on UK tax on their earnings emerging in the UK. Also UK resource returns paid to an overseas company needs to be devoid of tax obligation.

Report this wiki page